Fishtail 2022 Year in Review

2022 presented a number of challenges for the global trade industry. Most significant (to us) is the continued widening of the trade finance gap, which is now believed to have surpassed $2 trillion (up from 1.7 trillion in 2020).

This increasing demand and banks' inability to meet it has only strengthened our determination to make capital more accessible globally, responsibly, and faster.

According to the International Chamber of Commerce, in 2020 90% of trade finance was provided by just 13 banks. This concentration of power can make it difficult for SMBs to access the financing they need. In fact, the World Trade Organization estimates that over half of trade finance requests from SMBs are rejected, compared to a rejection rate of just 7% for multinational corporations. This creates significant barriers for SMBs looking to enter or expand in the global market. It is for this reason that Fishtail has focused on providing financing to SMBs in emerging markets, helping these businesses overcome such challenges and succeed on the global stage.

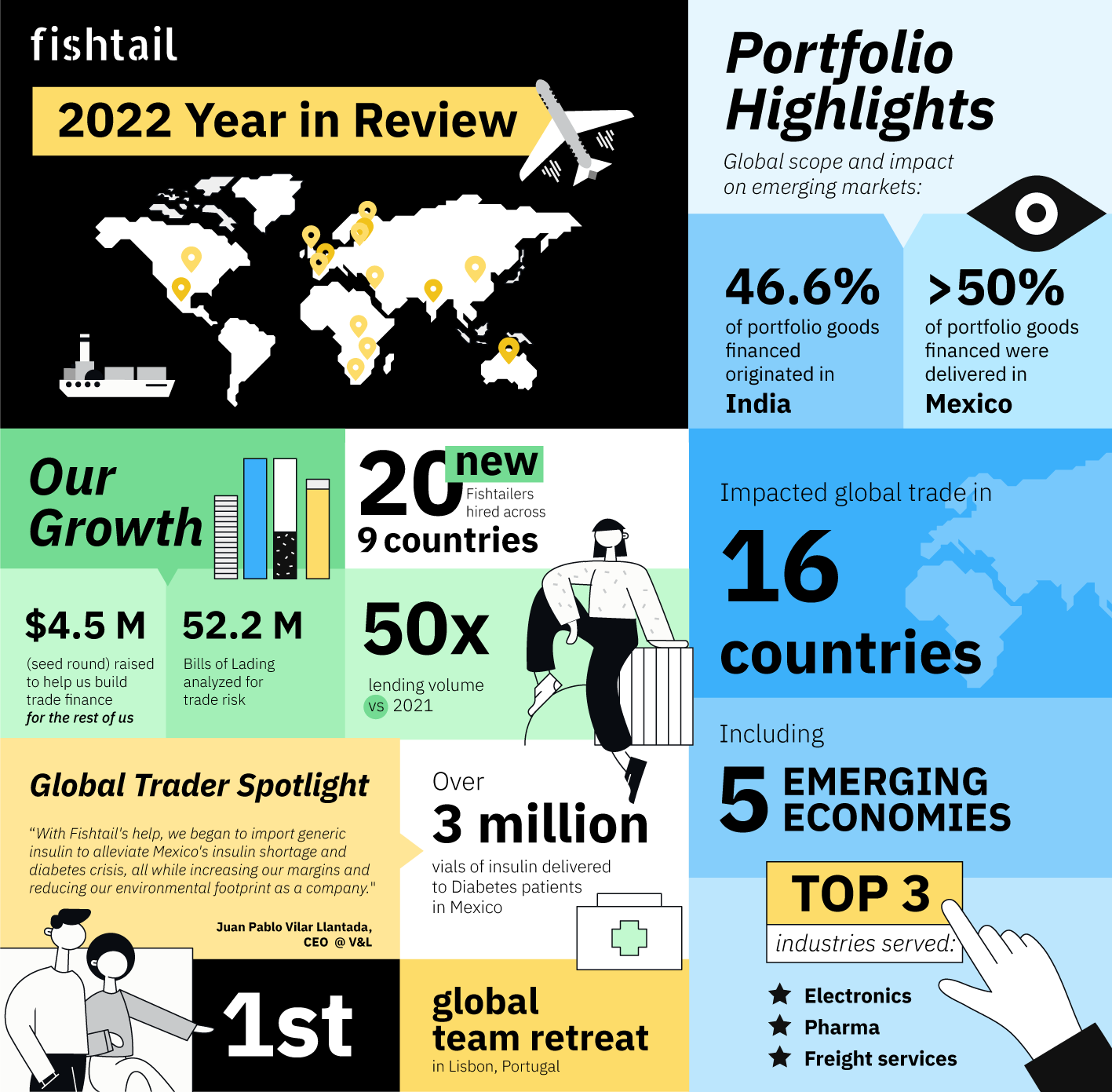

As we prepare to turn the page to a new year, we want to take a moment to look back at progress we made in 2022. We are grateful for the support of our Fishtail community, including our team, partners, investors, advisors, and especially our customers - enabling their missions allowed us to impact global trade in 16 countries, and bring trade finance to a wider audience.

Let’s take a closer look at Fishtail’s 2022 global reach, portfolio highlights and overall growth (and be sure to read to the end for an inspiring success story from one of our global traders).

Portfolio highlights: Global scope and impact on emerging markets

Electronics, pharmaceuticals, and freight services were the top 3 industries that we financed in 2022, contributing to trade in 16 countries, including (at least) five emerging ones. We are committed to supporting businesses across a range of sectors and geographies, and are proud to have made a meaningful contribution to the growth and success of our clients and the economies they trade in:

.png?width=1563&height=998&name=Map%20(1).png)

Growth: Funding, expansion and lending

In the first quarter of 2022, we secured a $4.5 million seed funding round led by Thursday Ventures, with participation from three leading data, fintech, and supply chain investors: Rackhouse Ventures, Amara Ventures, and project44. These funds have enabled us to significantly expand our team, our product development capabilities and overall operations. Our lending volume has increased by 50 times (compared to 2021), and we welcomed 20 new team members from 9 different countries to the Fishtail team.

We even planned and hosted our first global team retreat in Lisbon, Portugal!

.jpg?width=304&height=229&name=PXL_20220711_195046067.MP%20(1).jpg)

A key area of focus for our company has been the expansion of our data team, as we rely on big-data analytics to inform our decision-making and drive our business forward. Our data capabilities allow us to predict (almost) anything and everything, from the carbon emissions on a ship – to the probability that an invoice is going to get paid. We are committed to investing in and growing our data capabilities to continue providing valuable insights for our company and capitalize on new AI technologies.

Global Trader Spotlight: Saving lives in Mexico with Purchase Order financing

Until recently, diabetes was the second-leading cause of death in Mexico. In addition to poor country-wide diets, a shortage of insulin supply as well as high prices for the only available (branded) insulin were major contributors. A Mexican pharmaceutical company, V&L, identified the opportunity to save lives by importing generic insulin.

After setting up their initial supply chain with an Indian manufacturer, V&L was seeking a financing partner to help them launch their generic insulin business and support operations moving forward. Most pressing, V&L lacked access to working capital to enter the market, and subsequently meet growing demand. Banks were not a viable financing option as they were unfavorable to their supply chain and demand pattern complexities.

Within a year of Purchase Order Financing with Fishtail, V&L was able to:

- Establish a new product in the Mexican market and provide critical medical supplies to hospitals and government.

- Become the nation's largest government supplier of insulin.

- Deliver over 3 million vials of insulin to diabetes patients.

- Experience fast and steady growth, allowing them to not only achieve increased margins, but also be able to respond to increasing demand and, ultimately, save lives.

“With Fishtail's help, we began to import generic insulin to alleviate Mexico's insulin shortage and diabetes crisis, all while increasing our margins and reducing our environmental footprint as a company.”

Juan Pablo Vilar Llantada, CEO

2023

We are eagerly anticipating the potential for growth in the space in 2023 and are particularly excited about the opportunity to work towards sustainable trade finance while supporting the expansion of small and medium-sized businesses worldwide.

With our strong foundation in place and a dedicated team working to drive our business forward, we are well-positioned to capitalize on the opportunities that the market presents. We are constantly innovating and seeking out new ways to serve our customers and partners, and we are confident that 2023 will be a year of continued growth and success.